Something dramatic happened during October 2013 with Data Visualization (DV) Market and I feel it everywhere. Share Prices for QLIK went down 40% from $35 to $25, for DATA went down 20% from $72 to below $60, for MSTR went up 27% from $100 to $127 and for DWCH went up 25% from $27.7 to $34.5. This blog got 30% more visitors then usual and it reached 26000 visitors per month of October 2013!

So in this blog post I revisited who are actually the DV leaders and active players in Data Visualization field, what events and factors important here and I also will form the

DVIndex containing 4-6 DV Leaders and will use it for future estimate of Marketshare and Mindshare in DV market.

In terms of candidates for DV Index I need measurable players, so I will prefer public companies, but will mention private corporations if they are relevant. I did some modeling and it turned out that the best indicator for DV Leader if its YoY (Year-over-Year Revenue growth) is larger than 10% - it will separate obsolete and traditional BI vendors and me-too attempts from real DV Leaders.

Let's start with traditional BI behemoths:

SAP, IBM, Oracle and SAS: according to IDC, their BI revenue total $5810M, but none of those vendors had YoY (2012-over-2011) more then 6.7% ! These 4 BI Vendors literally desperate to get in to Data Visualization market (for example

SAP Lumira, IBM is getting desperate too with Project Neo (will be in beta in early 2014), Rapidly Adaptive Visualization Engine (RAVE), SmartCloud Analytics-Predictive Insights, BLU Acceleration, InfoSphere Data Explorer or

SAS Visual Analytics) but so far they were not competitive with

3 known DV Leaders (those 3 are part of DVIndex for sure) Qlikview, Tableau and Spotfire...

5th traditional BI Vendor -

Microsoft had BI revenue in 2012 as $1044M, YoY 16% and added lately a lot of relevant features to its Data Visualization toolbox: Power Pivot 2013, Power View, Power Query, Power Map, SSAS 2012 (and soon SQL Server 2014) etc. Unfortunately Microsoft does not have Data Visualization Product but pushing everything toward Office 365, SharePoint and Excel 2013, which cannot compete in DV market...

6th Traditional BI vendor -

Microstrategy made during October 2013 a desperate attempt to get into DV market by releasing 2 free Data Visualization products: Microstrategy Desktop and Microstrategy Express, which are forcing me to qualify Microstrategy for a status of DV Candidate, which I will include (at least temporary) into DVIndex. Microstrategy BI revenue for TTM (Trailing 12 months) was $574, YoY is below 5% so while I can include it into DVIndex, I cannot say (yet?) that Microstrategy is DV Leader.

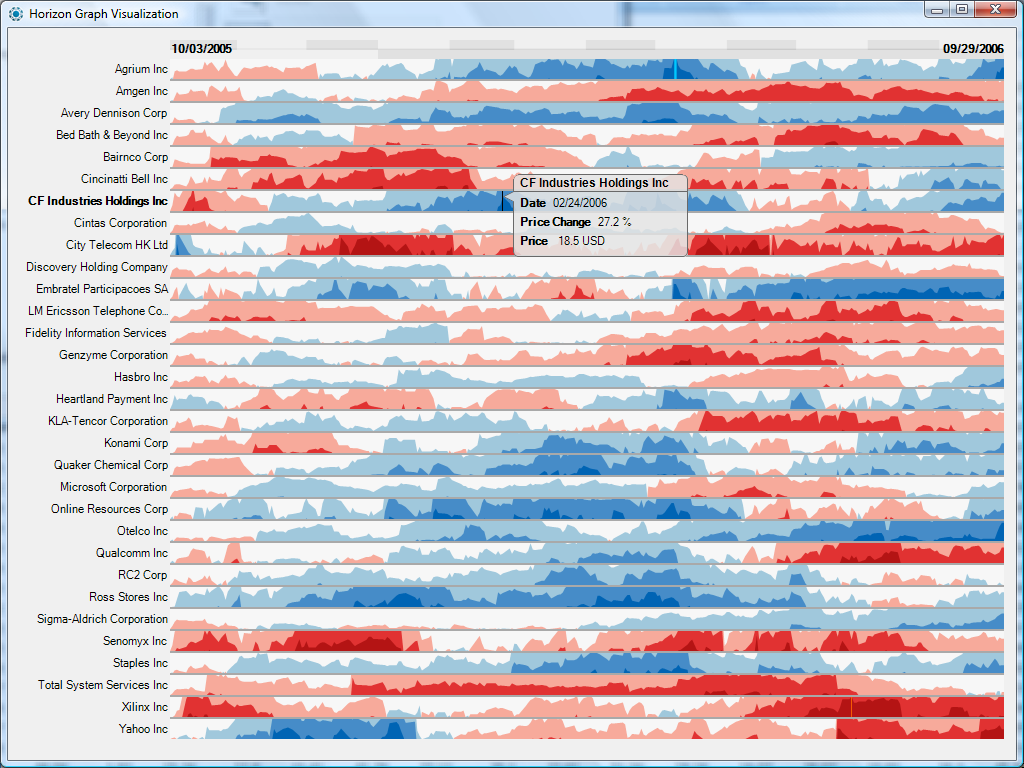

Datawatch Corporation is public (DWCH), recently bought advanced Data Visualization vendor - Panopticon for $31M. Panopticon TTM Revenue approximately $7M and YoY was phenomenal 112% in 2012! Combining it with $27.5M TTM Revenue of Datawatch (45% YoY!) giving us approximately 55% YoY for combined company and qualifying DWCH as a new member of DVIndex!

Other potential candidates for DVIndex can be

Panorama (and their Necto 3.0 Product),

Visokio (they have very competitive DV Product, called Omniscope 2.8),

Advizor Solution with their mature Advizor Visual Discovery 6.0 Platform), but unfortunately all 3 companies choose to be private and I have now way to measure their performance and so they will stay as DV Candidates only.

In order to monitor the progress of open source BI vendors toward DV Market, I also decided to include into DVIndex one potential DV Candidate (not a leader for sure) - Actuate with their BIRT product. Actuate TTM revenue about $138M and YoY about 3%. Here is the tabular MarketShare result with 6 members of DVIndex:

Please keep in mind that I have no way to get exact numbers for Spotfire, but I feel comfortable to estimate Spotfire approximately as 20% of TIBCO numbers. However, I feel Spotfire YoY is 16% which is higher then 11% TIBCO has. Numbers in table above are fluid and reflect the market situation by the end of October 2013. Also see my attempt to visualize the Market Share of 6 companies above in simple Bubble Chart (click on it to Enlarge; where * X-axis: Vendor's Revenue for last TTM: 12 trailing Months, * Y-axis: Number of Full-Time Employees, working for given Vendor, * Sized by Market Capitalization, in $B (Billions of Dollars), and * Colored by Year-Over-Year revenue Growth):

For that date I also have an estimate of Mindshare of all 6 members of DVIndex by using the mentioning of those 6 companies by LinkedIn members, LinkedIn groups, posted on LinkedIn job openings and companies with Linkedin profile:

Again, please see below my attempt to represent Mindshare of those 6 companies above with simple Bubble Chart ((click on it to Enlarge; here 6 DV vendors, positioned relatively to their MINDSHARE on LinkedIn and where * X-axis: Number of LinkedIn members, mentioned Vendor in LinkedIn profile, * Y-axis: Number of LinkedIn Job Postings, with request of Vendor-related skills, * Sized by number of companies mentioned them on LinkedIn and * Colored by Year-Over-Year revenue Growth):

Again, please see below my attempt to represent Mindshare of those 6 companies above with simple Bubble Chart ((click on it to Enlarge; here 6 DV vendors, positioned relatively to their MINDSHARE on LinkedIn and where * X-axis: Number of LinkedIn members, mentioned Vendor in LinkedIn profile, * Y-axis: Number of LinkedIn Job Postings, with request of Vendor-related skills, * Sized by number of companies mentioned them on LinkedIn and * Colored by Year-Over-Year revenue Growth):

Among other potential DV candidates I can mention some recent me-too attempts like

Yellowfin, Domo, RoamBI, Zoomdata and similar companies (mostly private startups) and hardly commercial but very interesting toolkits like

D3. None of them have impact on DV Market yet.

Now, let's review some of October events (may add more October events later):

2. Tableau Software Files Registration Statement for Proposed Secondary Offering. Also Tableau's Revenue in the three months ended in September

rose to $61 million, 10 millions more then expected - Revenue jumped 90%! Tableau CEO Christian Chabot said the results were boosted by one customer that increased its contract with the company. "Our third quarter results were bolstered by a large multimillion-dollar deal with a leading technology company," he said. "Use of our products in this account started within one business unit and over the last two years have expanded to over 15 groups across the company. "Recently, this customer set our to establish an enterprise standard for self-service business intelligence, which led to the multimillion-dollar transaction. This deal demonstrates the power and value of Tableau to the enterprise." However DATA prices went down anyway in anticipation of a significant portion of these Shares Premium prices should quickly evaporate as the STOCK Options lock-up will expire in November 2013.

3. TIBCO TUCON 2013 conference somehow did not help TIBCO stock but in my mind brought attention to Datawatch and to the

meteoric rise of DWCH stock (on Chart below compare it with

QLIK and

TIBX prices, which basically did not change during period of March-October of 2013) which is more then tripled in a matter of just 8 months

(Datawatch bought and integrated Panopticon during exactly that period):

1. For the fourth quarter, Qliktech predicts earnings of 28 cents to 31 cents a share on revenue between $156 million and $161 million. The forecast came in significantly lower than analysts' expectations of 45 cents a share on $165.78 million in revenue. For the full year, the company projects revenue between $465 million and $470 million, and earnings between 23 and 26 cents a share. Analysts had expectations of 38 cents a share on $478.45 million. As far as I concern it is not a big deal, but traders/speculants on Wall Street drove QLIK prices down almost 40%

4. Datawatch now

has potentially better software stack then 3 DV Leaders, because of Datawatch Desktop is integrated with Panopticon Desktop Designer and Datawatch Server is integrated with Panopticon Data Visualization Server; it means that in addition to "traditional" BI + ETL + Big Data 3V features (Volume, Velocity, Variety) Datawatch has 4th V feature, which is relevant to DV Market: the advanced Data Visualization. Most visualization tools are unable to cope with the "Three V's of Big Data" – volume, velocity and variety. However, Datawatch's technology handles:

- Data sources of any size (it has to be tested and compared with Qlikview, Spotfire and Tableau)

- Data that is changing in real time (Spotfire has similar, but Qlikview and Tableau do not have it yet)

- Data stored in multiple types of systems and formats

We have to wait and see how it will play out but competition from Datawatch will make Data Visualization market more interesting in 2014... I feel now I need to review Datawatch products in my next blog post...